This is the 31-8-25 DDO. The structure of today’s overview will be, the TSMSs firsts, followed by the DAREs. After that, we’ll have a look at our asset class valuation metrics, the USTAV, and MTAV. Then we’ll look at the overall ROCs, and the DXY. We’ll finish off by adding some notes, and my thoughts on what has happend, on what i believe can happen, and then the portfolio composition signals.

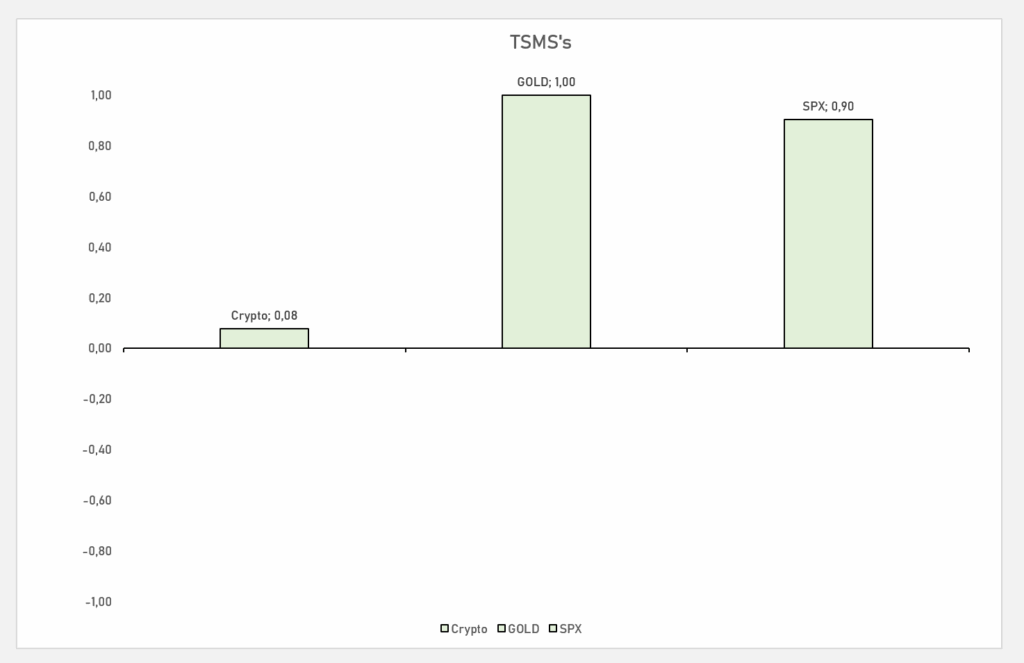

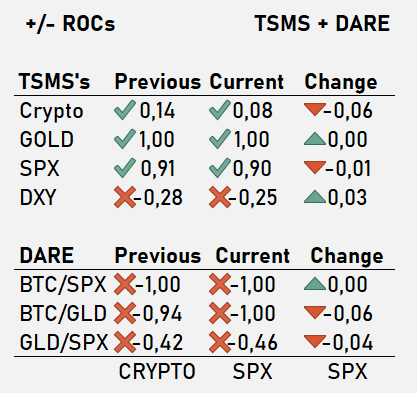

Lets have a look at the TSMSs first:

All 3 TSMSs are currently LONG. This, however, may change rapidly looking at the Crypto TSMS. Its score having rapidly declined over the last couple of days, and now sitting at a score of only +0.08.

The GOLD TSMS score has in turn rapidly increased recently. A somewhat rare perfect +1.00 score is nice to see.

The SPX-TSMS is still going strong, having had a score of at least +0.70 for more than 2 months now.

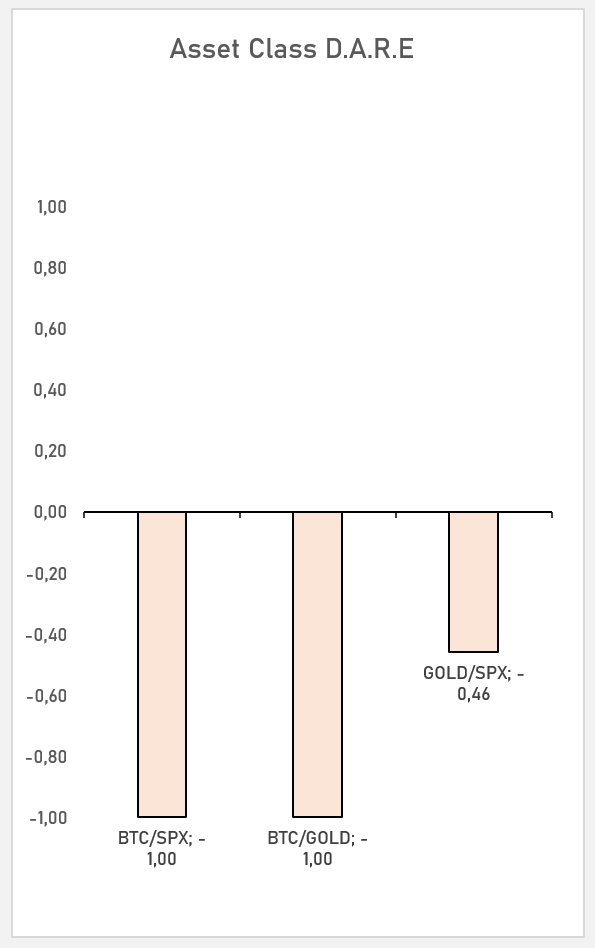

Now the DAREs:

Looking a the asset class DAREs we can easilly see that crypto isn’t the place to be right now. Currently, it underperforms both gold and the SPX500. Both DAREs sitting at a firm -1.00 score.

The GOLD/SPX DARE has been rising slowly over the last couple days. it could very well turn LONG given golds strong performance.

Stocks remain dominant.

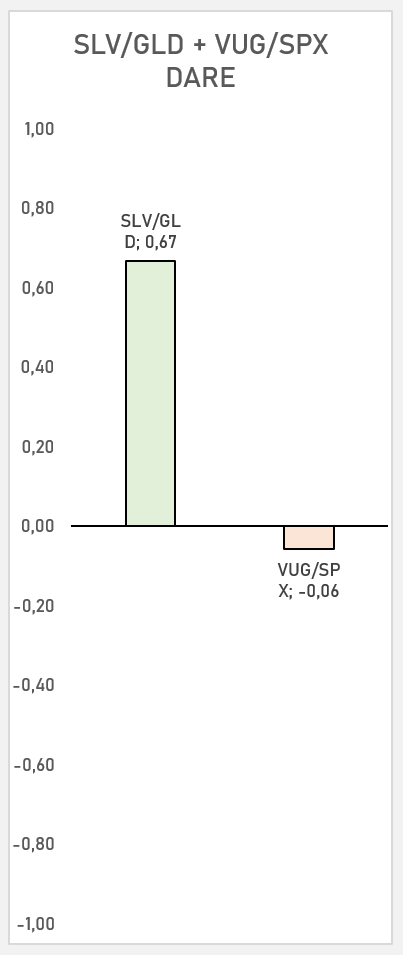

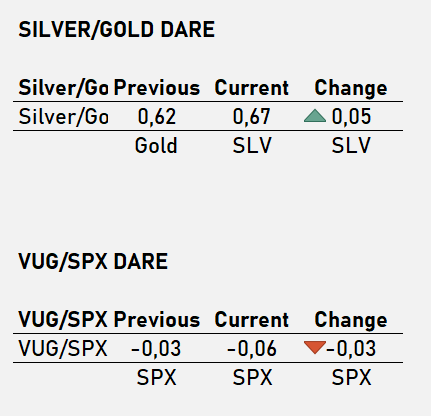

The Silver/Gold DARE is still going strong, having regained its ‘July’ strength, moving from +1.00 on 30-7, to only +0.23 on 4-8, and now regaining its strength back to a score of +0.67. During August, silver has secured and extra ~5% gain over gold, which by itself gained 5% in the same period, making for a total gain of about ~10% for silver.

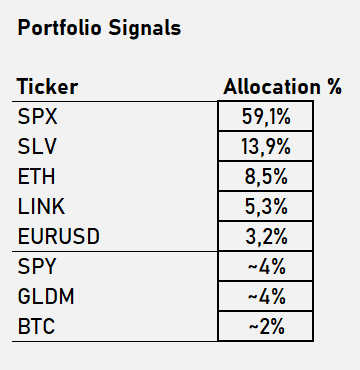

The VUG/SPX DARE has flipped negative to a score of -0.06, comming down from a perfect +1.00 score on 12-8. From its absolute bottom on April 7th, VUG has secured an extra 10% in gains up to the point where the ratio switched SHORT. With the asset class DARE still favoring SPX over BTC and gold, we’ll rotate from VUG -> SPX for our majority holdings.

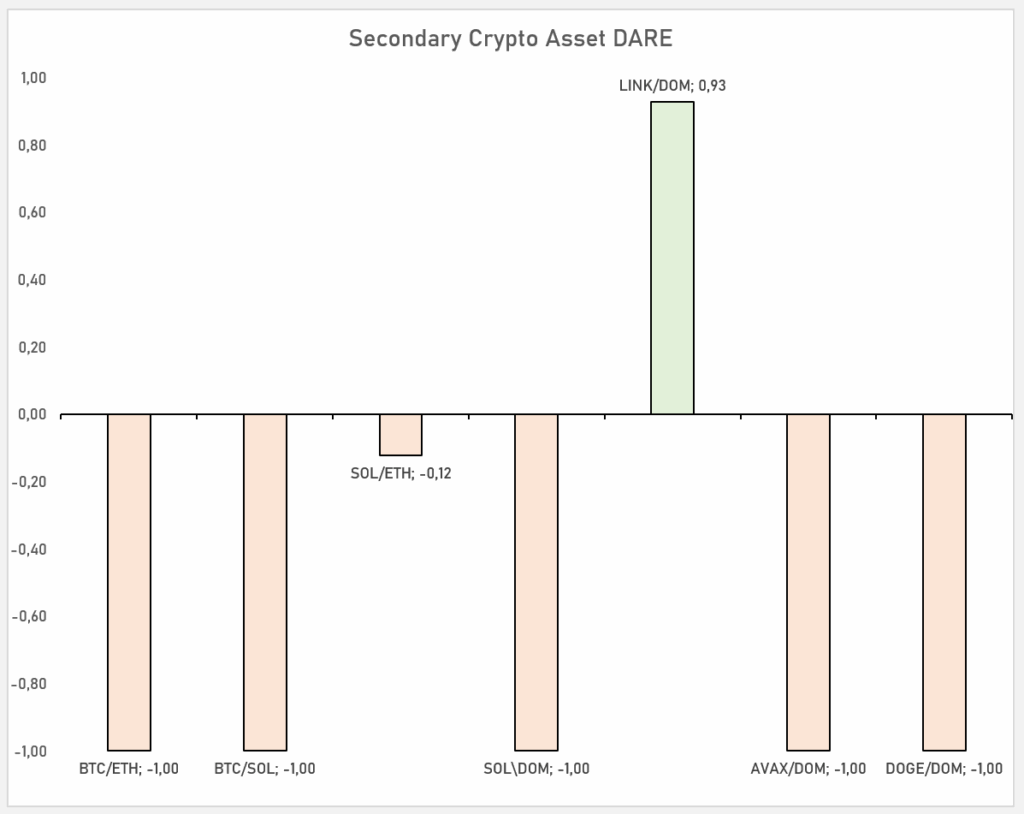

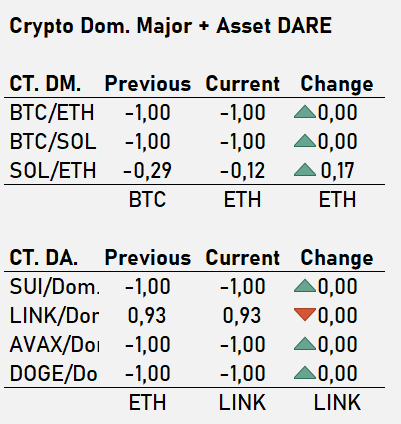

With a -1.00 Score for both the BTC/ETH, and BTC/SOL ratio, the Crypto DARE still selects Etherium as our Dominant-Major, since the SOL/ETH ratio is still SHORT. However, we may rotate from ETH -> SOL soon given the SOL/ETH ratio has risen from a -1.00 in the middle of August, to an almost positive score of -0.12.

Looking at our secondary crypto asset DARE, we see that only LINK has a positive score (+0.93). All other assets are scored with a firm -1.00. Its score has come down slightly from +0.97 to +0.93, but no real weakness has been measured.

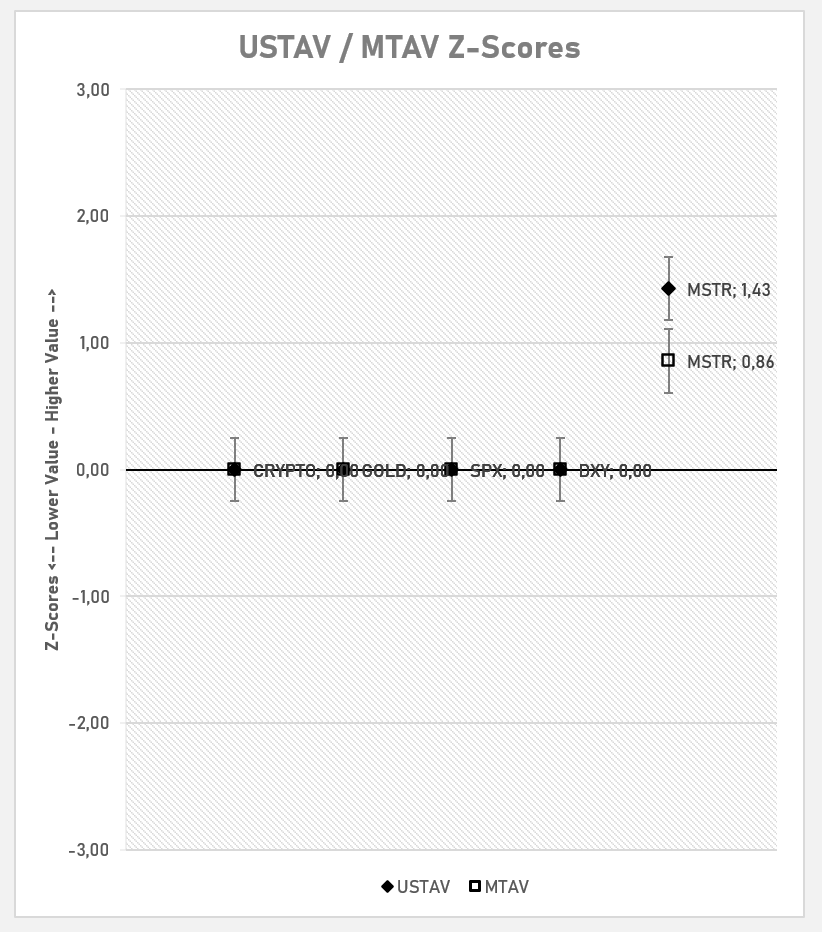

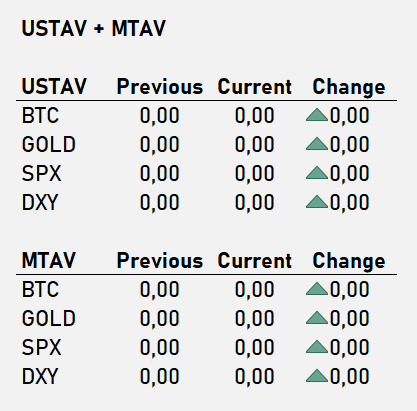

USTAV and MTAV:

There is currently no USTAV, or MTAV, given we’re busy backtesting, and recalibrating some of their components. We expect them to be online again shortly.

+/- ROCs:

Today we see only minor ROCs. Nothing special.

DXY Information:

Regarding the DXY there isn’t much to say. Its TSMS is at a score of -0.25, having come down from being positive in the beginning of August. The overall expectation is for the DXY is to weaken further over the next few months. EURUSD: 1.16847

Portfolio Signals:

Leave a Reply