A quick and simple overview of what we have to offer, and on what to do with the information.

*We’ve selected a few older graphs and images to use as examples. The data presented is old and irrelevant*

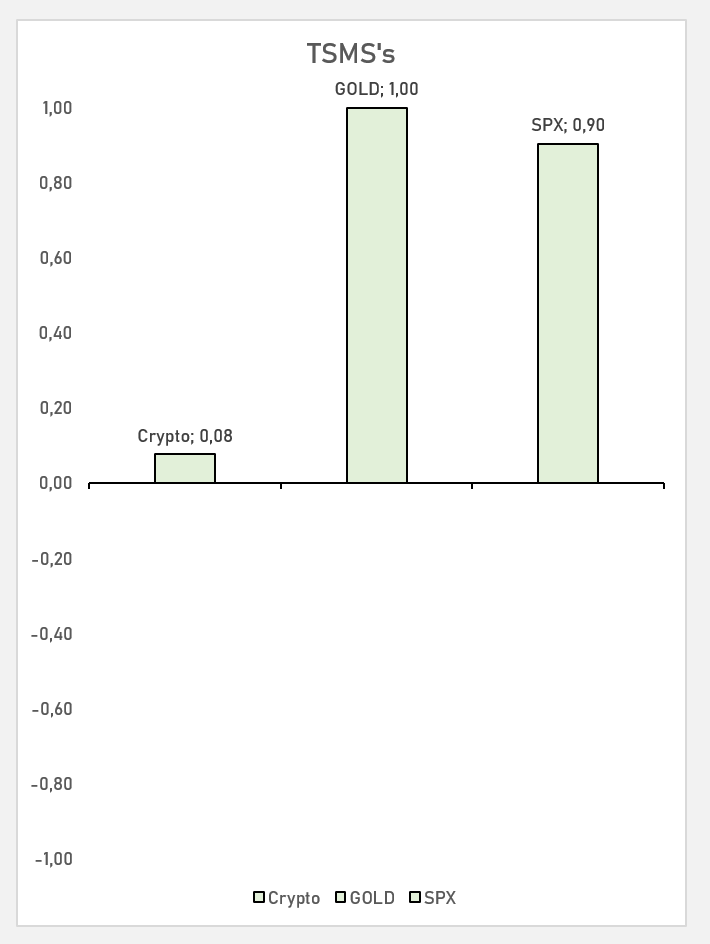

TSMS

TSMS stands for Trend-Strength-Measuring-System. It scores the current momentum of a trend of an asset by combining indicator scores between +1 and -1. A score >0 indicates positive momentum/consensus (LONG), A score <0 indicates negative momentum/consensus (SHORT)

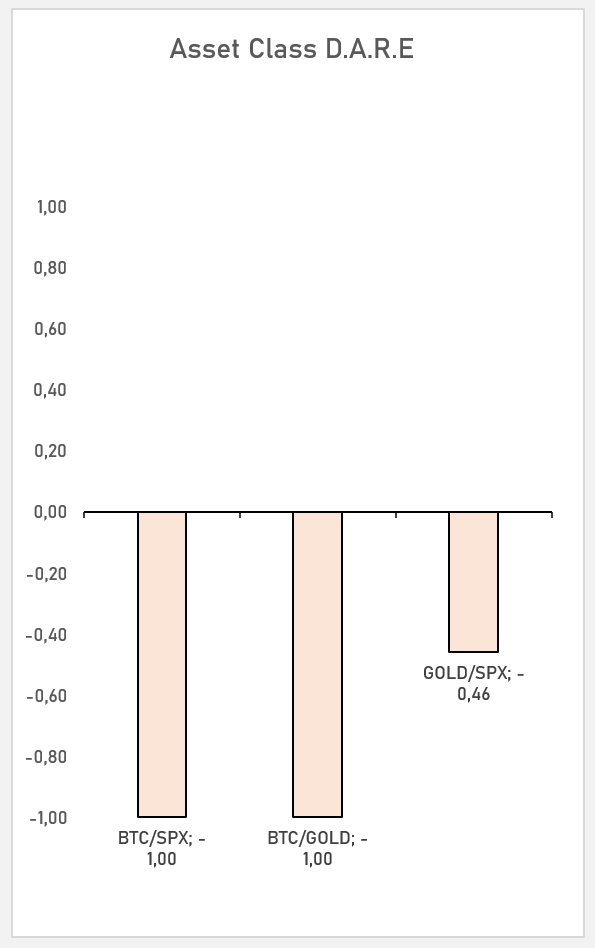

DARE

DARE works like a TSMS, but it’s made specificaly for ratios. It doesn’t measure the momentum of an asset by itself, but it denominates it by other assets, to see which one’s outperforming. Allowing us to be more optimally allocated. A score >0 indicates positive momentum/consensus (LONG), A score <0 indicates negative momentum/consensus (SHORT) between two different types of assets.

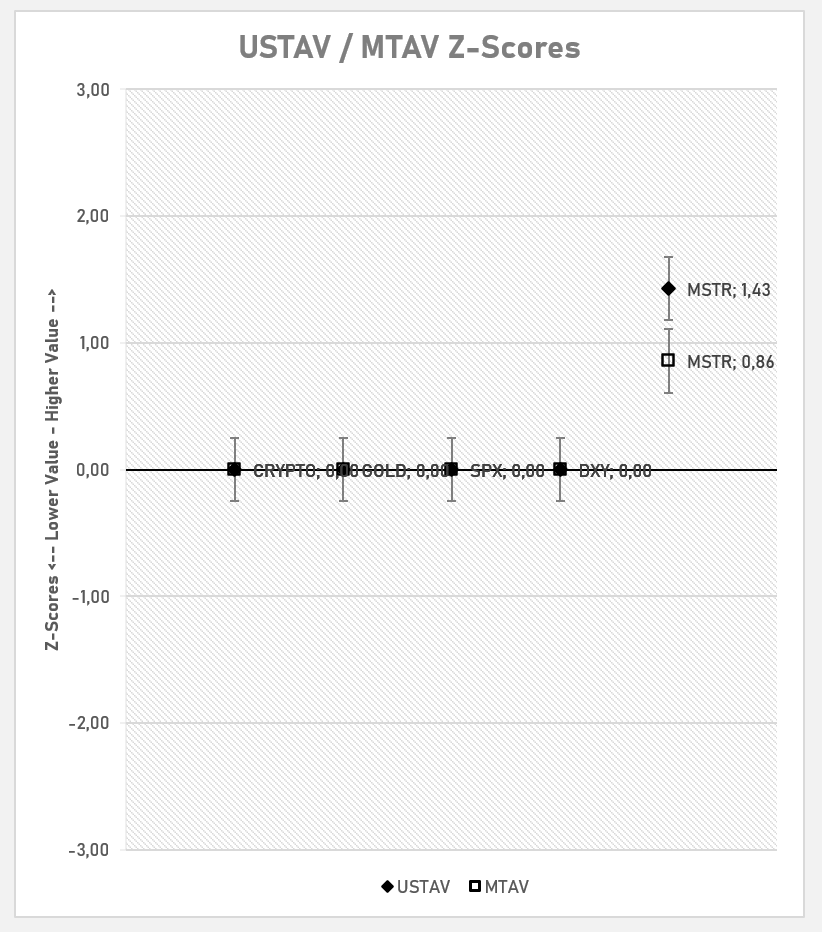

USTAV/MTAV

The USTAV and MTAV work by extracting a Z-Score (between -3, and +3 SD) from multiple indicators. It helps us to determine the current ‘value’ of an asset over an ‘ultra-short-term’ and ‘medium-term’ timespan. A score of <0 indicating lower asset valuation, and a score of >0 indicating a higher asset valuation.

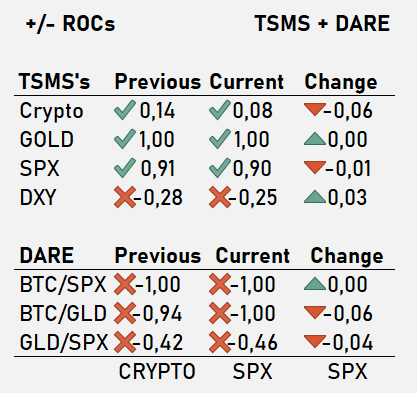

ROC

ROC stands for ‘rate-of-change’. We present you this graphic to showcase the current ROCs of the TSMSs,DAREs, and USTAV/MTAV in a more organized manor.

Leave a Reply